Policies

The Company’s RCGM and Corporate Governance policies cited therein are posted on its website under the Governance section at CG Manual and Policies.

Corporate Governance Policies

Revised Corporate Governance Manual ("RCGM")

The Company’s RCGM institutionalizes the principles of good corporate governance throughout the organization. It lays the foundation to the Company’s compliance system and identifies the roles and responsibilities of the Board and Management, as well as the rights of all shareholders, including minority shareholders, and the protection of their interests. Likewise, it requires adoption of and/or discloses the Company policies such as (1) Anti-Bribery and Anti-Corruption; (2) Board Diversity; (3) Board Nomination and Election; (4) Conflict of Interest; (5) Dividend Policy; (6) Material Related Party Transactions; (7) Stakeholders Health, Safety, and Welfare; (8) Whistleblowing; and (9) Succession Planning and Remuneration, among others.

The RCGM, company policies, Board and Committee Charters, and the Corporate Governance organizational structure are regularly reviewed to ensure compliance with regulatory issuances and to keep pace with the constant development of corporate governance best practices. Continuous improvement and monitoring of governance and management policies have been undertaken to ensure that the Company observes good governance. The Company also consistently strives to raise its financial reporting standards by adopting and implementing the prescribed Philippine and International Financial Reporting Standards.

Code of Business Conduct and Ethics ("Code")

The fundamental principle of this Code is the expectation that all JGSHI directors, officers, employees, subsidiaries, and affiliates conduct their dealings in the best interest of the Company and in accordance with the highest legal and ethical standards, with a firm stance against corrupt practices. Thus, everyone must observe the Company’s core values, acceptable norms, and the policies indicated in the Code in all of our business activities and future endeavors.

Compliance Reports

1. Integrated Annual Corporate Governance Report (“I-ACGR”)

In compliance with SEC Memorandum Circular No. 15 series of 2017 for all PLCs to disclose the Company’s compliance or noncompliance with the recommendations provided under the CG Code, the Company submitted the 2023 Integrated Annual Corporate Governance Report (“I-ACGR”) to the SEC and PSE on May 28, 2024. This can be accessed in the Governance section of its website under Compliance Reports - IACGR.

2. Compliance Manual

The Company has a compliance program or manual, approved on March 29, 2023, and covers compliance with relevant laws, regulations, and policies that are regularly reviewed. The manual has the following contents: i.) Compliance System, ii.) Compliance Structure; iii.) Compliance Program, iv.) Compliance Review, and v.) Compliance Training and Awareness initiatives.

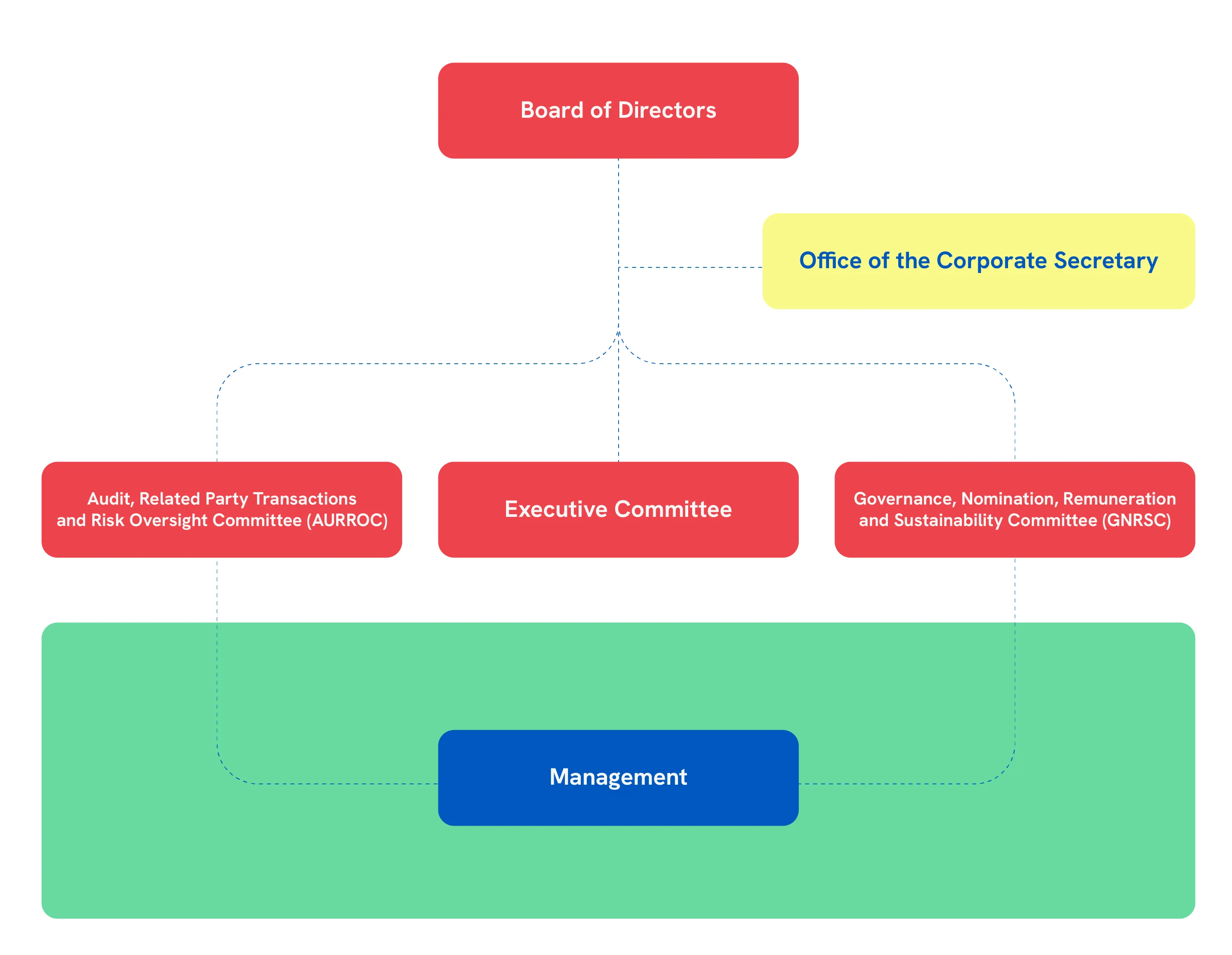

Governance Framework

Click the diagram to view

The governance framework of JGSHI is fundamental to ensuring that it operates in alignment with its core values of Entrepreneurial Mindset, Stewardship, and Integrity. At the heart of this structure is the Board of Directors, which plays a critical role in providing strategic direction and overseeing the governance of the Company, including its overall strategy, ERM effectiveness, sustainability initiatives, climate-related risks, and opportunities.

To support the Board in effectively fulfilling its roles and responsibilities, several Board Committees have been established, including: i) the Audit, Related Party Transactions, and Risk Oversight Committee (“AURROC”), ii) the Executive Committee (“ExCom”), and iii) the Governance, Nomination, Remuneration, and Sustainability Committee (“GNRSC”). Further details regarding the AURROC and GNRSC are provided in the “Board Committees” section of this Sustainability Report.

The Board and its Committees are supported by the Office of the Corporate Secretary, which plays a key role in facilitating communication between the Board of Directors, Board Committees, Management, and shareholders.

Moreover, the Board and its Committees work closely with Management to ensure that the Company achieves its objectives and strategic goals. The roles of the key officers of Management outlined in the “Management Leadership Chart” section of this Sustainability Report, are discussed below:

The President and Chief Executive Officer (CEO) oversees the operations of the Company and manages human and financial resources in accordance with the strategic plan. He also provides leadership for Management in determining, developing, and implementing business strategies, plans, and budgets to the extent approved by the Board. He provides the Board with a balanced and understandable account of the Company’s performance, financial condition, results of operations, and prospects, on a regular basis. He defines the overall strategic direction for the conglomerate, encompassing its approach to sustainability and climate action. The President and CEO plays a pivotal role in driving initiatives, managing risks, and ensuring transparent reporting on performance.

The Corporate Secretary assists the Board and the Board Committees in the conduct of their meetings, including preparation of the annual schedule of Board and Committee meetings and the annual Board calendar. She also assists the Chair and its Committees in setting agendas for the meetings, attends Corporate Governance trainings, safekeeps and preserves the integrity of the minutes of the meeting of the Board and its Committees, as well as other official records of the Company. The Corporate Secretary is a lawyer by profession, and possesses all the qualifications and none of the disqualifications to hold the position.

The Chief Finance and Risk Officer (CFRO) leads the financial reporting, controllership, and corporate forecasting functions, guiding the Company to make sound business and financial decisions. He ensures a sound ERM framework is in place to effectively identify, monitor, assess, and manage key business risks, including sustainability and climate-related risks. He communicates significant risk exposures, control issues, and risk mitigation strategies to the AURROC. Under the risk and controls function, the CFRO is the steward of risk management, specifically those that have financial impact and affect company value.

The Chief Legal Officer (CLO) offers expert and strategic legal advice to senior management, overseeing all legal and regulatory matters within the company. She plays a pivotal role in safeguarding the company's legal interests, particularly in areas such as labor law, mergers and acquisitions, litigation, and other commercial and corporate matters. Additionally, she ensures the organization operates in compliance with all relevant laws and regulations. The CLO also manages legal and regulatory risks and leads the in-house legal team.

The Chief Audit Executive (CAE) is in charge of periodically reviewing and ensuring the implementation of the Internal Audit charter, and internal audit plan, and presenting it to the Senior Management and the AURROC for approval, coordinating activities with the work of other internal and external assurance and advisory/consulting service providers as needed, submitting to the AURROC a risk-based internal audit plan for review and approval, communicating to the AURROC the impact of resource limitations on the internal audit plan, ensuring adherence to the Company’s relevant policies and procedures, and emerging trends and successful practices in internal auditing are considered. The CAE likewise provides independent assessments to the AURROC, Management and outside parties on the adequacy and effectiveness of governance, risk management, and control processes for the Company.

The Chief Corporate Affairs and Sustainability Officer (CCASO) oversees the conglomerate’s efforts in government affairs, communications, and sustainability. The CCASO is responsible for managing the key relationships with external stakeholders such as government agencies, regulators, industry associations, and the media, including addressing any issues or crises that may impact corporate reputation. He ensures government mandates on sustainability are complied with and sustainability principles and best practices are duly considered across all business units. The CCASO collaborates with the Chief Strategy Officer in overseeing the development of sustainability and climate strategies, metrics and targets for the conglomerate.

The Sustainability and Corporate Social Responsibility Head reports to the CCASO and oversees the preparation and disclosure of sustainability reports ensuring compliance and transparency. The Sustainability Head collaborates with the Enterprise Risk Management (ERM) and Corporate Strategy teams to integrate sustainability and climate-related risks and opportunities into the company's strategy and risk management framework. Additionally, the Sustainability Head engages with relevant internal and external stakeholders to discuss and build support for key sustainability related initiatives and policies.

The Chief Strategy Officer is in charge of assisting the Board in overseeing the long-term OGSM of the Company and executing the same to ensure an effective management performance that is attuned to the Company’s business environment and culture. He ensures that sustainability and climate considerations are integrated into the company's broader business strategy and that ecosystem synergies are maximized. The CSO also participates in investor conferences, roadshows, and other engagement platforms to communicate the company's strategy, goals, and progress directly to investors.

The Investor Relations Officer is tasked to effectively manage the two-way communication between the capital markets and the JGSHI leadership team to drive shareholder value maximization.

The Chief Compliance Officer monitors, reviews, evaluates, and ensures compliance by the Company, its directors, officers, and employees with the provisions and requirements of the relevant laws, rules, and regulations. She also attends Corporate Governance trainings, ensures the integrity and accuracy of all documentary submissions to the regulators, identifies possible areas of compliance issues, and works towards their resolution. She assists the Board and the GNRSC in the performance of their governance functions, including their duties to oversee the formulation or review and implementation of the Corporate Governance framework and policies of the Company.

The Board of Directors

A. Responsibilities of the Board

The Board is primarily responsible for the governance of the Company. A competent and working Board heads JGSHI to ensure the Company’s unremitting success and sustain its competitiveness and profitability in a manner consistent with its OGSM and the long-term best interests of shareholders and other stakeholders. They exercise care, exceptional skill, and sound judgment, as well as observe good faith and loyalty in the conduct and management of the Company’s businesses and affairs. This ensures that all the Company’s actions are within the scope of power and authority prescribed in the Articles of Incorporation, By-Laws, and existing laws, rules, and regulations. Accordingly, the Board performs its duties and responsibilities conscientiously and with honesty and integrity, in accordance with and as disclosed in the Company’s Revised Corporate Governance Manual (“RCGM”), Board and Committee Charters, and policies.

1. Roles and Functions

a. The Chairman

The Board is headed by a competent and qualified Chairman, who presides at all meetings of the Board and shareholders. He also assists in ensuring compliance with and implementing corporate governance policies and practices. He ensures that the agenda focuses on strategic matters and guarantees that the Board receives accurate, timely, relevant, insightful, concise, and clear information to enable it to make sound decisions.

The detailed duties and responsibilities of the Chairman can be referenced in the RCGM.

In JGSHI, the position of the Chairman of the Board is separate from the President and CEO to further strengthen the Board’s independence. This is to ensure a clear distinction between the Chairman’s responsibility to manage the Board that exercises corporate powers and conducts business and the CEO’s responsibility to manage the executives that implement the policies in the conduct of the business in accordance with the Company’s By-Laws and RCGM. The Chairman of the Board is Mr. James L. Go, while the President and CEO is Mr. Lance Y. Gokongwei.

b. Independent Directors

The Board has Independent Directors, who occupy four (4) out of the nine (9) Board seats or more than one-third (1/3) of the members of the Board, and who possess all the necessary qualifications and none of the disqualifications to hold the position. They are independent of management and the controlling Shareholders and are free from any business or other relationship that could, or could reasonably be perceived to materially interfere with their exercise of independent judgment in carrying out their responsibilities as Directors.

c. Lead Independent Director

The Company’s RCGM provides that the Board may consider designating a Lead Independent Director among the Independent Directors if the Chairman of the Board is not an Independent Director and if one person holds the position of the Chairman of the Board and CEO. His role is to lead the independent directors and guide the Board in cases where matters of conflict of interest may arise.

On June 3, 2024, the Board re-appointed Independent Director Antonio L. Go as the Lead Independent Director to perform the following functions: i.) To serve as an intermediary between the Chairman and the other directors when necessary; ii.) To convene and chair meetings of the Non-Executive Directors; and iii.) To contribute to the performance evaluation of the Chairman, as required.

B. Composition and Qualification

1. Incumbent Board (2024 Individual Profiles)

The Directors’ biographical details are set out in the JGS Annual Report SEC Form (17A) December 2024 (Part 1), Part III Control and Compensation Information, Item 9, Directors or Leadership page of the Annual/Sustainability Report.

Chairman: James L. Go (Non-Executive Director and Non-Independent Director)

Lead Independent Director: Antonio L. Go (Non-Executive and Independent Director)

Members:

- Lance Y. Gokongwei (President and CEO)

- Robina Gokongwei-Pe (Non-Executive and Non-Independent Director)

- Patrick Henry C. Go (Executive and Non-Independent Director)

- Johnson Robert G. Go, Jr. (Non-Executive and Non-Independent Director)

- Renato T. De Guzman (Non-Executive and Independent Director)

- Artemio V. Panganiban (Non-Executive and Independent Director)

- Bernadine T. Siy (Non-Executive and Independent Director)

2. Board Diversity

The Company recognizes the benefits of having a diverse Board and its value in maintaining sound corporate governance while achieving strategic objectives and sustainable growth. Board diversity shall be considered from varied aspects when structuring the Board’s composition, including but not limited to gender, age, culture and educational background, geographical location, professional experience, skills, knowledge, and length of service of directors, among others. Likewise, in the implementation of its Board Diversity Policy, JGSHI does not discriminate by reason of ethnicity, nationality, political, or religious backgrounds of its directors, officers, and employees. Specifically for the Board, when searching for candidates for director, the Company uses professional search firms or other external sources as a policy. Thus, the incumbent Board is diverse in terms of expertise, gender, professional experience, and academic backgrounds.

In line with the RCGM, Board Diversity Policy, and Nomination and Election Policy framework, the Governance, Nomination, Remuneration, and Sustainability Committee (GNRSC) reviewed the structure, size, and composition of the Board. In accordance with its objective of having at least four Non-Executive Independent Directors, including one female, with diverse backgrounds beneficial to the Company's business that possess all necessary qualifications, Ms. Bernadine T. Siy was elected to the Board of Directors during the Annual Stockholders’ Meeting on June 3, 2024. Currently, there are two female directors in the Board: one Non-Executive Independent Director and one Non-Executive Non-Independent Director.

3. Nomination and Election

The Company’s directors are elected at the Annual Stockholders’ Meeting to serve until the next annual meeting and until their respective successors are elected and qualified. In 2024, the Board’s composition, with all members meeting the necessary qualifications and none of the disqualifications, is as follows: three (3) Non-Executive Directors, four (4) Independent Directors, and two (2) Executive Directors, including the President and CEO. Currently, the Company has two female Directors—one (1) Non-Executive Director, Ms. Robina Gokongwei-Pe, and one (1) Independent Director, Ms. Bernadine T. Siy, who was elected at the 2024 Annual Stockholders’ Meeting.

4. Board Competencies (Matrix)

Each Director provides a unique business perspective, experience, and skill set that are all valuable to the Company.

| Expertise | JLG | LYG | RGP | PCG | JRG | RDG | ALG | AVP | BTS |

|---|---|---|---|---|---|---|---|---|---|

| Governance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Sustainability and Climate Change | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Audit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Risk | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Business Management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Legal | ✓ | ✓ | |||||||

| Economics | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Finance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Education | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Technology | ✓ | ✓ | ✓ | ||||||

| INDUSTRY | |||||||||

| Oil | ✓ | ✓ | |||||||

| Retail | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Transportation | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Food and Beverage | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Property | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Telecommunications | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Power | ✓ | ✓ | ✓ | ✓ | |||||

| Petrochemical | ✓ | ✓ | ✓ | ||||||

| Healthcare | ✓ | ✓ | ✓ | ✓ | |||||

| Media | ✓ | ✓ | |||||||

| AGE & GENDER | |||||||||

| Age* | 85 | 58 | 63 | 54 | 59 | 74 | 84 | 88 | 65 |

| Gender | M | M | F | M | M | M | M | M | F |

*For data on age, refer to JGS Annual Report SEC Form (17A) December 2024 (Part 1), Part III, Item 9 (1) Directors.

C. Board and Board Committee Meetings

1. General Requirements: Quorum, Notification, Frequency

The Board diligently makes informed and prudent decisions, consistently acting in the best interest of the company and its shareholders. The Company requires a meeting quorum of 2/3 for board decisions, except for the election of officers, which requires a vote of majority of all members of the board. In accordance with the Company’s By-Laws, board meetings are scheduled in the last quarter of the preceding year, with regular sessions held and special meetings convened when required by business exigencies. The Board receives meeting notices and agendas, and other relevant meeting materials at least five (5) business days prior to each meeting, to allow for review before said meetings. As seen in the Certificate of Attendance of Meetings uploaded in the website, all Directors have complete attendance for 2024.

In 2024, the Board met sixteen (16) times and there was a quorum (2/3 of the number of directors) in all meetings. There was a total of eight (8) Board Committee meetings in 2024: four (4) AURROC Meetings, and four (4) GNRSC meetings, which included updates on Governance and Sustainability. All the members of the Board were likewise present in the ASM.

On August 7, 2024, under the chairmanship of Mr. Go as the Lead Independent Director, the Non-Executive Directors (“NEDs”) and Independent Directors (“IDs”) met without executives present. Likewise, on November 7, 2024, they had a meeting with the External Auditor (“EA”), Chief Audit Executive (“CAE”), Chief Finance and Risk Officer (“CFRO”), and Chief Compliance Officer (“CCO”). On the same date, the IDs, who are members of AURROC, had a meeting with the External Auditor without anyone from management present.

2. Attendance in Board Meetings and ASM

| Board | Name | Date of Election | ASM | Board Meetings | NED and IDs' Meetings |

|---|---|---|---|---|---|

| Chairman | James L. Go | June 3, 2024 | 1/1 | 16/16 | N/A |

| Member | Lance Y. Gokongwei | June 3, 2024 | 1/1 | 16/16 | N/A |

| Member | Patrick Henry C. Go | June 3, 2024 | 1/1 | 16/16 | N/A |

| Member | Johnson Robert G. Go, Jr. | June 3, 2024 | 1/1 | 16/16 | N/A |

| Member | Robina Gokongwei Pe | June 3, 2024 | 1/1 | 16/16 | N/A |

| Independent | Jose T. Pardo* | May 15, 2023 | N/A | 8/8 | N/A |

| Independent | Renato T. De Guzman | June 3, 2024 | 1/1 | 16/16 | 3/3 |

| Independent (Lead) | Antonio L. Go | June 3, 2024 | 1/1 | 16/16 | 3/3 |

| Independent | Artemio V. Panganiban | June 3, 2024 | 1/1 | 16/16 | 3/3 |

| Independent | Bernardine T. Siy* | June 3, 2024 | 1/1 | 8/8 | 3/3 |

11 - Special meetings; 4 – regular meetings; 1 - Organizational meeting

*Ms. Bernadine T. Siy replaced Mr. Jose T. Pardo

3. Attendance in Board Committee Meetings

Audit, Related Party Transaction, Risk Oversight Committee (AURROC) Meetings

| Board | Name | Date of Election | No. of Meetings Attended |

|---|---|---|---|

| Chairman | Antonio L. Go | June 3, 2024 | 4/4 |

| Member | Renato T. De Guzman | June 3, 2024 | 4/4 |

| Member | Jose T. Pardo* | May 15, 2023 | 2/2 |

| Member | Artemio V. Panganiban | June 3, 2024 | 4/4 |

| Member | Bernardine T. Siy* | June 3, 2024 | 2/2 |

| Advisory Member | James L. Go | June 3, 2024 | 4/4 |

*Ms. Bernadine T. Siy replaced Mr. Jose T. Pardo

Governance Nomination Remuneration and Sustainability Committee (GNRSC) Meetings

| Board | Name | Date of Election | No. of Meetings Attended |

|---|---|---|---|

| Chairman | Jose T. Pardo* | May 15, 2023 | 2/2 |

| Member | Renato T. De Guzman | June 3, 2024 | 4/4 |

| Member | Antonio L. Go | June 3, 2024 | 4/4 |

| Member | Artemio V. Panganiban | June 3, 2024 | 4/4 |

| Chairperson | Bernadine T. Siy* | June 3, 2024 | 2/2 |

*Ms. Bernadine T. Siy replaced Mr. Jose T. Pardo

D. Board Committees

For a better and more focused attention on the affairs of the Company and to aid in the optimal performance of its roles and responsibilities, the Board approved the delegation of particular matters to two (2) Board Committees, namely: i.) Audit, Related Party Transactions and Risk Oversight Committee (AURROC) and ii.) Governance, Nomination, Remuneration, and Sustainability Committee (GNRSC).

1. AURROC

a. Roles and Functions

Audit, Related Party Transactions and Risk Oversight Committee (“AURROC”)

As provided in the Company’s RCGM and the AURROC Charter, the role of the AURROC is to oversee the Company’s financial reporting, internal control system, internal and external audit processes, and monitor compliance with applicable laws and regulations and internal policies for efficiency and effectiveness of business operations, and proper safeguarding and use of the Company’s resources and assets; to ensure that the group-wide policy and system governing Material Related Party Transactions (“MRPTs”), particularly those that breach the materiality threshold is in place and effectively working including review and approval thereof to guarantee that transactions are transparent, conducted fairly and at arm’s length; and to oversee the establishment of Enterprise Risk Management (“ERM”) framework that will effectively identify, monitor, assess, manage, and report key business risks as well as provide oversight over its risk management policies and procedures. In addition to these, under the RCGM and the AURROC Charter, the AURROC has the primary responsibility to appoint and remove the external auditor as well as the head of internal audit.

i. Audit and Accountability

- Internal Audit

The Board ensures that its shareholders receive a balanced and comprehensible quarterly assessment of the Company’s performance, position, and prospects. Interim and other reports that could adversely affect its businesses, including its submissions and disclosures to the SEC and PSE, are also made available on the company website.

The Board also appointed Rya Aissa S. Agustin as the Chief Audit Executive upon the recommendation of the AURROC to perform the Internal Audit function, pursuant to the RCGM.

The Internal Audit Group is focused on adhering to its purpose, mission, and vision to be the trusted advisors of the Board and Management and become world-class internal audit professionals who deliver independent, objective, quality, and agile audit services at benchmark value, enabled by innovative audit systems and technologies.

The activities of the Internal Audit Group are governed by an Internal Audit Charter, which is approved and reviewed periodically by the AURROC. The Internal Audit adopts a risk-based audit approach and performs a dynamic risk assessment to consider new and emerging risks. The Internal Audit Group provides independent and objective assurance, consulting, and investigative services to assess and enhance the overall control environment encompassing governance practices, risk management, internal controls, and compliance with applicable laws and regulations.

To create a competitive advantage through Governance, Risk Management and Compliance (“GRC”) scale and synergies, the Internal Audit Group continues to work closely with the internal audit teams of the different business units through benchmarking and sharing knowledge, best practices, and tools.

The Internal Audit Group provides continuing training and professional development programs to remain relevant and keep up with the conglomerate’s evolving business needs.

- External Audit

The RCGM and AURROC Charter provide that the AURROC shall ensure the integrity and independence of Internal and External Auditors, perform oversight functions over the Company’s Internal and External Auditors to review and monitor their independence and objectivity, and review and monitor compliance with applicable laws and regulations. The AURROC shall likewise review and monitor the External Auditor’s effectiveness on an annual basis. The External Auditor shall be rotated or changed every five (5) years or earlier. In the event of the removal or change of the External Auditor, the AURROC shall provide justifications and ensure proper disclosure of the reasons for such removal or change.

The Board, after consultations with the AURROC, recommends to the Shareholders a competent External Auditor duly accredited by the SEC (under Group A category) who shall undertake an independent audit of the Corporation. SyCip, Gorres, Velayo & Co., the External Auditor appointed, has the ability to understand complex related party transactions, its counterparties, and valuations of such transactions, adequate quality control procedures, and agrees to be subjected to the SEC Oversight Assurance Review (SOAR) Inspection Program conducted by the SEC’s Office of the General Accountant (OGA).

The AURROC evaluates and approves all non-audit services conducted by the External Auditor. Below is a table of all audit and non-audit related fees in 2024:

| Name of Auditor | Audit and Non-Audit-Related Fees | Yr. 2024 |

|---|---|---|

| SyCip, Gorres, Velayo & Co. | Fees for services that are normally provided by the external auditor in connection with statutory and regulatory filings or engagements |

PHP 5,620,000.00 |

| All Other Fees | PHP 115,500.00 | |

| Total | PHP 5,735,500.00 |

No other service was provided by external auditors to the Company for the calendar year 2024.

ii. Related Party Transaction

The Company conducts all MRPTs on an arm’s length basis, on fair and reasonable terms and conditions no less favorable than any such terms available to unrelated third parties under the same or similar circumstances. The MRPT Policy ensures that accountability of the Board and Management for MRPTs are in place. Aside from disclosure of conflict of interest, directors, and officers with material interests in any transaction and an actual or potential conflict with the Company abstain from participating in the deliberation of the same.

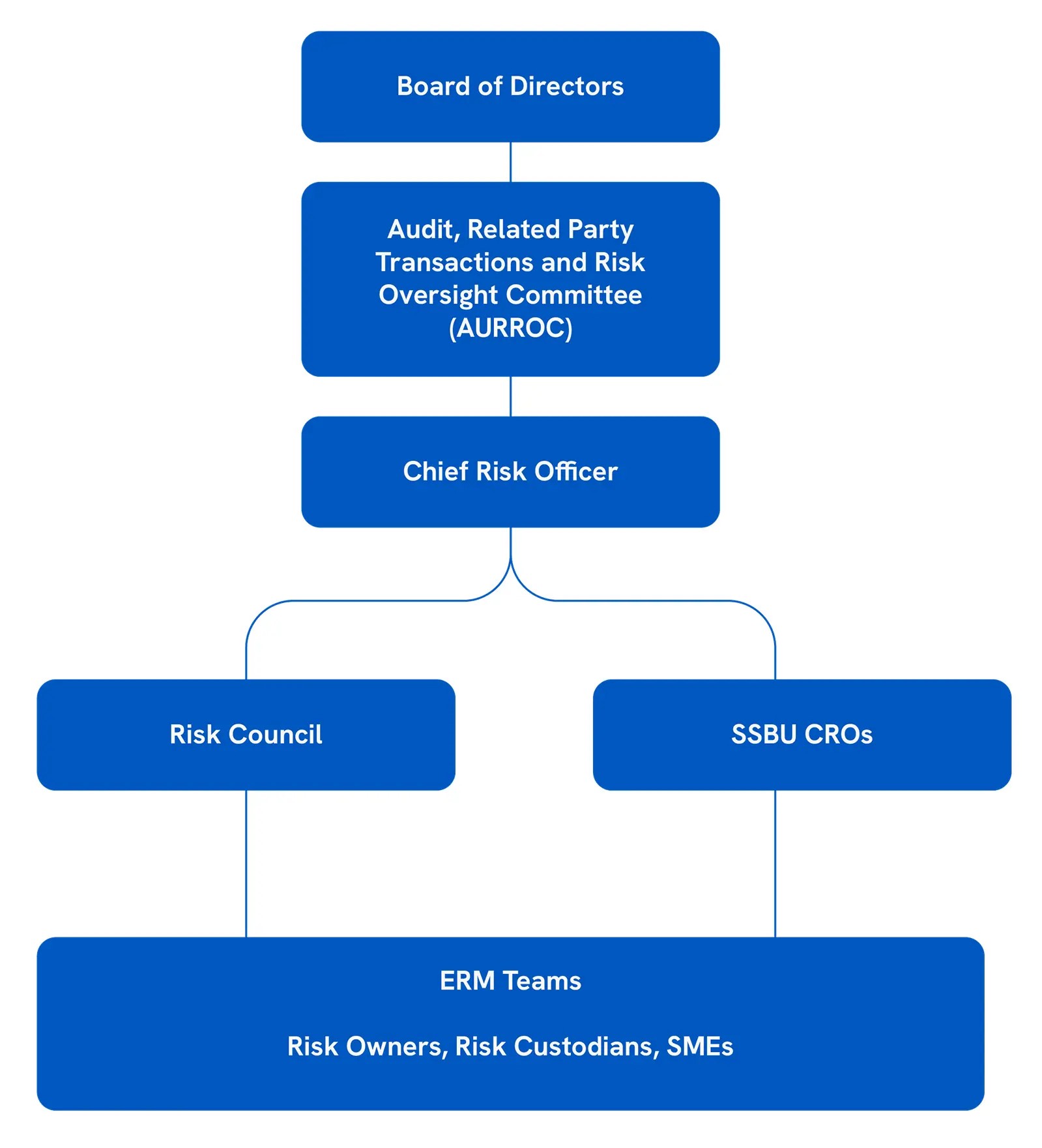

iii. Enterprise Risk Management

Effective risk governance is fundamental to the Company’s ERM framework, ensuring a structured approach to identifying and managing key business risks. The governance structure provides clear lines of responsibility and accountability, guiding the Board and Management in overseeing risk exposures at both the business unit and enterprise levels. This includes the governance of sustainability-related and climate-related risks, reinforcing the Company’s commitment to integrating these important risks into its overall risk management approach.

Click the diagram to view

- The Board of Directors (BOD) provides oversight to JGSHI’s risk management practices and sets guidelines in managing critical risks.

- The Audit, RPT and Risk Oversight Committee (AURROC) supports the BOD by monitoring the implementation of and assessing the effectiveness of the ERM framework.

- The Chief Executive Officer (CEO) holds ultimate accountability for the overall risk management approach of the company, ensuring that risk considerations are embedded in strategic decision-making and operations.

- The Chief Risk Officer (CRO) leads the development and implementation of the ERM framework and processes and is responsible for reporting risk exposures and mitigation efforts to Senior Management and AURROC.

- The Risk Council, composed of JGSHI functional heads, supports the CRO in identifying and addressing significant risk exposures and in overseeing the Company’s risk management strategies. Additionally, SBU CROs participate in Risk Council meetings to provide insights into the key risks affecting their respective business units, and support efforts to achieve a well-aligned and cohesive risk management approach across the Group.

- Risk Owners are accountable for the identification and management of risks in their assigned areas of responsibility, and communicating risk status and progress to the relevant stakeholders.

- Risk Custodians support the Risk Owners in the monitoring, analysis and reporting of risk status, trends, and progress of mitigation initiatives.

- The ERM Team supports the CRO in the development, continuous improvement and effective implementation of the ERM framework and methodologies across the organization.

- The Internal Control Team ensures that robust control mechanisms are in place to mitigate risks effectively, conducts periodic evaluations on the adequacy and effectiveness of controls and communicates significant control weaknesses or breaches to Management and AURROC.

- The Internal Audit Team provides independent assurance to Management and AURROC on the adequacy and effectiveness of the Company’s risk management and internal control processes.

iv. Internal Controls

To further advocate the Company’s commitment to the pursuit of good governance and achieving compliance with applicable laws and Company policies and procedures, the Company ensures to strengthen the Enterprise Governance, Risk Management and Compliance (GRC) Culture and maintains a strong system of internal controls focused on accountability and oversight of operations. With the leadership of the Company’s CFRO, internal control is embedded in the company’s operations and each Business Unit (BU) and Corporate Center Unit (CCU). To accomplish the established goals and objectives, the BUs and CCUs implement robust and efficient process controls to ensure: i.) Compliance with policies, procedures, laws, and regulations; ii.) Economic and efficient use of resources; iii.) Check and balance and proper segregation of duties; iv.) Identification and remediation control weaknesses; v.) Reliability and integrity of information; and vi). Proper safeguarding of company resources and protection of company assets through early detection and prevention of fraud.

The annual Statement of Internal Controls and Compliance System Attestation (“SICCSA“) for 2024, is signed by the Chief Audit Executive, Chief Finance and Risk Officer, and President and Chief Executive Officer. It attests that the Corporation’s internal controls, risk management and compliance system, and governance practices are adequate, and was reported in AURROC and to the Board. This is in accordance with the Board’s function to annually review the internal control system and risk management framework of the Company. The 2024 SICCSA cited in the SEC 17-A (Annual Report) and the Internal Audit Charter are both available in the “Internal Controls“ portion of the “Shareholders” tab of the “Corporate Governance” page of the Company website.

b. Composition

The Board Committee Chairman and Members, who are all Independent Directors, and have finance, accounting and/or business administration background, are as follows:

AURROC

- Chairman: Antonio L. Go (ID)

- Members:

- Jose T. Pardo* (ID)

- Bernadine T. Siy* (ID)

- Renato T. De Guzman (ID)

- Artemio V. Panganiban (ID)

- Advisory Member: James L. Go (NED)

*Ms. Bernadine T. Siy replaced Mr. Jose T. Pardo effective June 3, 2024.

2. GNRSC

a. Roles and Functions

As provided in the Company’s RCGM and the GNRSC Charter, the role of the GNRSC is to oversee the development and implementation of Corporate Governance principles and policies and perform oversight functions on the Economic, Environment, Social, and Governance aspects of Sustainability, and recommend a formal framework on the nomination, and evaluation of the performance of the Directors and Senior Management to ensure that this framework is consistent with the Company’s culture, strategies, and the business environment. This includes the following functions: oversight of the implementation of a Corporate Governance framework and periodic review of the same to ensure that it remains relevant to the Company; monitor compliance with the Code of Business Conduct and Ethics and accompanying Corporate Governance policies; oversee Board evaluation and continuing education/training; implement remuneration matters for corporate and individual performance; define and approve the nomination, election, and succession planning for the Board and key officers; and provide guidance and oversee policy-making on the Company’s sustainability strategies, programs, initiatives, and reports. The GNRSC also evaluates management’s effectiveness in maximizing climate-related risks and opportunities into JGSHI’s strategy planning.

i. Governance Programs

Compliance Monitoring and Implementation

Business Conduct and Anti-corruption Programs and Procedures

The ethical and behavioral standards expected of directors, officers and employees are set out and embodied in the Company’s Code of Business Conduct and Ethics, Anti-Corruption Programs, Company Policies, and Offenses Subject to Disciplinary Action (“OSDA”), among others. The same are disseminated to all directors and employees across the Company through trainings and advisories to embed them in the Company culture. On October 31, 2024, JGSHI launched its annual online refresher course of the Code of Business Conduct and Ethics and completed 100% training compliance for both its directors and employees by the end of 2024. Likewise, new employees undergo an orientation program on the Company’s policies and procedures (e.g., Business Conduct and Ethics) embedded in its Darwinbox System.

The anti-corruption programs and procedures of the Company cover the following: i.) Conflict of Interest, ii.) Conduct of Business and Fair Dealings, iii.) Receipt of Gifts from Third Parties, iv.) Compliance with Laws and Regulations, v.) Confidential Information, vi.) Use of Company Funds, Assets and Information, vii.) Disciplinary Action, viii.) Whistleblowing, and ix.) Resolution of Conflicts.

JGSHI participates in organizations engaged in programs in the field of corporate governance, compliance, and business ethics, which enables the Company to have access to materials, discussions, and trainings related to corporate governance, as well as interact with other governance and ethics professionals around the world. JGSHI representatives are members of the Good Governance Advocates and Practitioners of the Philippines, Institute of Corporate Directors, and the International Bar Association, and attend their trainings.

Risk assessments are conducted on various aspects of the business, such as strategic, governance, operational, legal, and compliance. This process encompasses assessing the risk of corruption and bribery within the organization and external parties.

Conflict of Interest Disclosures

Directors and employees of the Conglomerate are required to comply annually with the Self-Disclosure Activity on Conflict of Interest and Declaration of Gifts Received pursuant to the CG Code, and as embodied in the Company’s Code of Business Conduct and Ethics and Conflict of Interest Policy.

As such, on May 21, 2024, the Company commenced the Annual Self-Disclosure of Conflict of Interest and Declaration of Gifts Received covering calendar year 2023 until the date of disclosure. All directors and employees of JGSHI submitted their self-disclosure forms and out of 295 employees, 16 employees disclosed a conflict of interest. The IECON investigated, evaluated, and resolved all disclosures.

Whistleblowing

Integrity and Ethics Council

The Company also has an established suitable framework for whistleblowing. It allows employees and other stakeholders to freely communicate, without fear of any form of retaliation, concerns about any aspect of business operation (e.g., violations of Company policies, its Code of Business Conduct and Ethics, criminal or unlawful acts or omissions, instances when an act or omission endangers the health and safety of employees) and any other complaints including unethical practices or behavior, misconduct, malpractice, irregularities or risks against the Company. All information received in connection with the reports are strictly confidential and not disclosed to any person without prior consent of the Integrity and Ethics Council (“IECON”). Internal and external persons reporting have the option to use either email, iSpeak, or send mail through the postal services and have direct access to JGSHI’s designated Lead Independent Director (“LID”) through its IECON, a unit created to handle whistleblowing concerns that directly reports all whistleblowing incidents to the LID.

Any employee, business partner, and other stakeholders may discuss or disclose in writing any concern or potential violation of the Code of Business Conduct and Ethics with the IECON. Reports can be done through email using the following contact details:

Email: iecon@jgsummit.com.ph

Mailing Address: IECON JG Summit Holdings, Inc., 40/F Robinsons Equitable Tower ADB Avenue corner Poveda St., Ortigas Center, Pasig City, Metro Manila, Philippines

Online Platform: “iSpeak“ is an online whistleblowing portal available for access/by the public on the Company’s website through this link: iSpeak

The above-mentioned whistleblowing portals are likewise on the Contact Us page of the Company website.

In 2024, two (2) whistleblowing cases were received through the iSpeak channel directly intended for JGSHI, while no cases were submitted via email. The reports deemed valid were forwarded to the appropriate Strategic Business Units (“SBUs”), and feedback on the actions taken were monitored and reported to the GNRSC and the Board.

C.2. iSpeak

On August 30, October 8, and December 12, 2024, pursuant to the Company’s Code of Business Conduct and Ethics and Conflict of Interest Policy, the Company released email communications encouraging employees to report whistleblowing concerns via iSpeak. In 2024, the IECON Secretariat received a total of 39 whistleblowing reports via the iSpeak portal. All 39 reports were valid. Out of the 39 reports, two (2) were reports related to JGS, while 37 were endorsed to the SBU for further handling.

C.3. Email

The IECON Secretariat received a total of 204 reports via the iecon@jgsummit.ph email address in 2024. Out of the 204 emailed reports, 15 reports were customer-related, 32 were employment-related, one (1) was request for information/data, 14 were regarding sponsorships or solicitation, 141 reports were for supplier offers/proposals/marketing/accreditation/job applications, while one (1) was addressed to an unrelated corporation. These emails received were no longer reported to the IECON as these were not whistleblowing cases.

ii. Nomination

Pursuant to the Board Election and Nomination Policy, the GNRSC pre-screens and shortlists all candidates nominated to become members of the board of directors, and considers engaging external sources, such as professional search firms, director databases and/or other reputable external sources to further enhance the search for and widen the base of potential nominees in accordance with the list of qualifications and disqualifications as defined in the Company’s Corporate Governance Manual.

iii. Remuneration

The Company, through the GNRSC, ensures that the remunerations of directors, officers, and employees are sufficient and competitive with other similar industries through market salary surveys to attract qualified and competent employees and retain them. Formal procedures for the development and implementation of succession planning and remuneration for directors and officers are in place through the Succession and Remuneration Policy.

The GNRSC recommends the remuneration for both Executive and Non-Executive Directors, subject to approval by the Board of Directors. The fixed remuneration for Non-Executive Directors (including Independent Directors) is based on the time commitment and responsibilities associated with the role. The remuneration for Executive Directors may include a fixed monthly salary, as approved by the Board in line with their appointment, along with variable pay tied to the Company’s and individual performance.

The GNRSC likewise defines the performance criteria and measurable standards, including climate and sustainability, which will determine the basis for the variable pay. Additionally, the Committee may consider aligning the remuneration of Key Executives and the Board with the long-term interests of the Company and its shareholders.

On the other hand, the compensation structure for Key Management Personnel and Senior Management Team members may consist of both a fixed salary and performance-based variable compensation. This framework will be designed to help the Company attract and retain top talent, ensuring effective management with a long-term strategic focus.

a. Board

| Director | Retainer Fee | Per Diem | Total | |

|---|---|---|---|---|

| Board Meetings | Committee | |||

| James L. Go | ₱600,000.00 | 240,000.00 | 120,000.00 | 960,000.00 |

| Lance Y. Gokongwei | ₱600,000.00 | 240,000.00 | - | 840,000.00 |

| Patrick Henry C. Go | ₱600,000.00 | 240,000.00 | - | 840,000.00 |

| Robina Gokongwei Pe | ₱600,000.00 | 240,000.00 | - | 840,000.00 |

| Johnson Robert G. Go, Jr. | ₱600,000.00 | 240,000.00 | - | 840,000.00 |

| Jose T. Pardo* (ID) | - | 120,000.00 | 120,000.00 | 240,000.00 |

| Renato T. De Guzman (ID) | ₱700,000.00 | 260,000.00 | 260,000.00 | 1,220,000.00 |

| Antonio L. Go (ID) | ₱800,000.00 | 280,000.00 | 270,000.00 | 1,350,000.00 |

| Artemio V. Panganiban (ID) | ₱700,000.00 | 260,000.00 | 260,000.00 | 1,220,000.00 |

| Bernadine T. Siy* (ID) | ₱700,000.00 | 140,000.00 | 150,000.00 | 990,000.00 |

| TOTAL | ₱5,900,000.00 | 2,260,000.00 | 1,180,000.00 | 9,340,000.00 |

*Ms. Bernadine T. Siy replaced Mr. Jose T. Pardo effective June 3, 2024.

b. Executive Compensation

The aggregate compensation given to officers and directors of the Company for the year 2024 is reported in the JGS Annual Report SEC Form (17A) December 2024 (Part 1), Part III, Item 10.

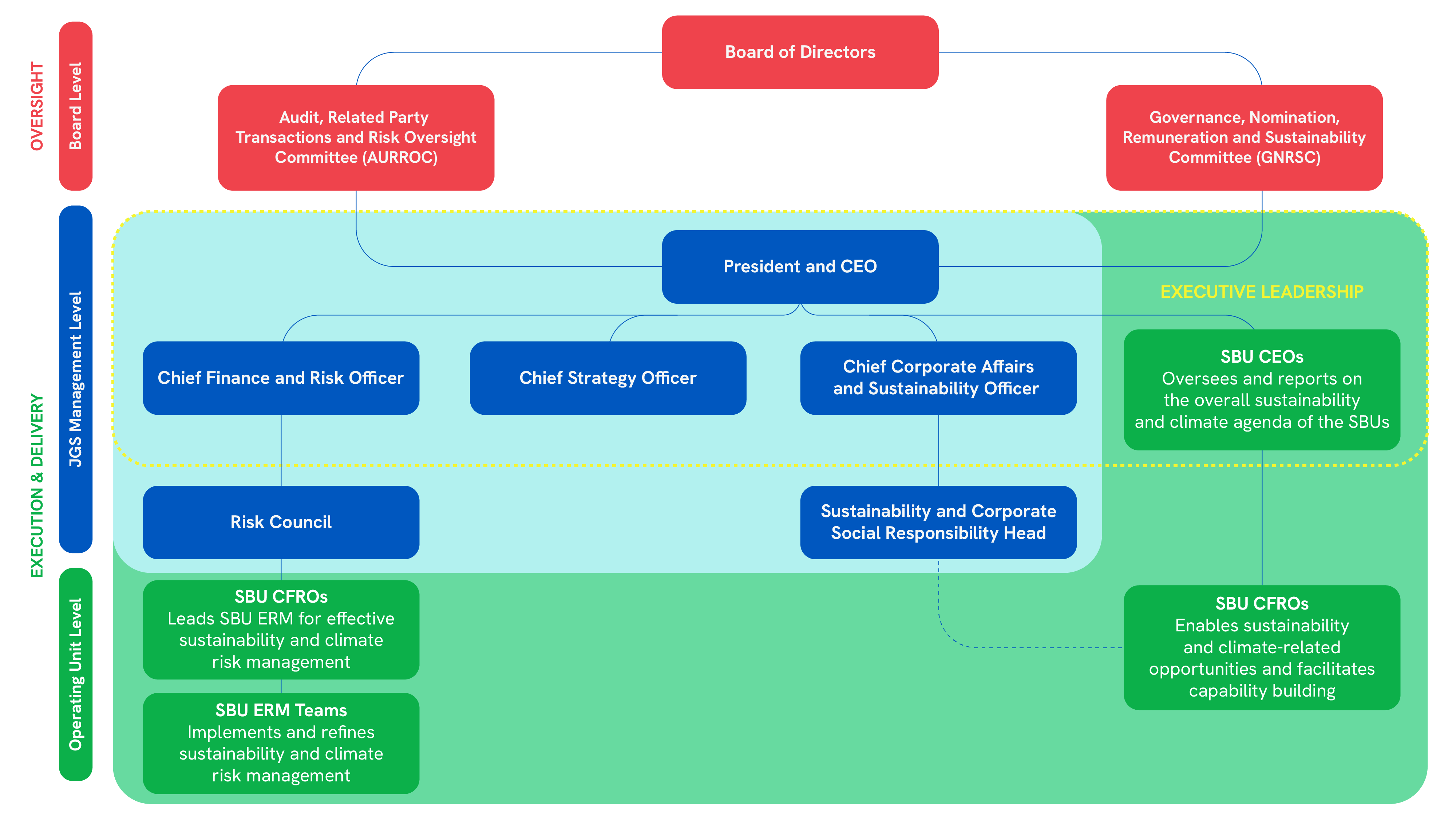

iv. Sustainability and Climate

Click the diagram to view

Effective governance in sustainability and climate-related matters is crucial for organizations aiming to address environmental challenges and promote long-term resilience. Our leadership framework is designed to proactively manage potential environmental, social and governance risks while also identifying and leveraging new opportunities.

Our governance structure facilitates informed decision-making at various levels:

- Board Oversight: The Board of Directors ensures top-level oversight, guaranteeing the effectiveness and alignment of our sustainability and climate strategy with corporate goals.

- Management Execution: The Management Team integrates sustainability and climate initiatives across the entire organization and regularly reports progress to the Board.

- Operational Integration: Operating units are responsible for implementing sustainability and climate strategies, embedding them into daily operations, and ensuring they align with the company's objectives and goals.

The Board is primarily responsible for overseeing sustainability and climate-related risks and opportunities.

The Board of Directors ensures that the sustainability and climate-related considerations are integrated into our strategies, procedures, and systems. Through the AURROC, the Board evaluates management's actions on risk matters and reviews and approves Objectives, Goals, Strategies, and Measures (OGSM) to drive our sustainability and climate initiatives across the group's businesses and stakeholder engagements.

The AURROC consistently updates the Board on sustainability and climate-related risks and significant exposures. It recommends changes to risk appetite and tolerance in response to business developments, regulatory shifts, and major external events. The AURROC oversees the management of the Enterprise Risk Management (ERM) framework, ensuring policies effectively address sustainability and climate-related risks for both operational and financial stability. It also directs the creation, execution, and assessment of our risk management plans.

Working alongside AURROC, the GNRSC supports the Board by overseeing the creation and implementation of corporate governance principles and policies, with a focus on Economic, Environment, Social, and Governance (EESG) aspects of sustainability. The GNRSC reviews and recommends the approval of our Sustainability and Climate Disclosure Report for submission to regulatory bodies and public release. It also assesses management's effectiveness in leveraging sustainability and climate-related opportunities.

Role of the Executive Leadership Council

The Executive Leadership Council, which includes Corporate Center Unit Heads and Strategic Business Unit CEOs, tackles sustainability and climate-related risks and opportunities. Under the leadership of the President and CEO, they formulate and implement strategies to manage these risks and leverage opportunities for the organization.

The roles of the Board and relevant officers belonging to the Executive Leadership Council in the illustration (President and CEO, CFRO, CSO, CCASO and Sustainability Head) are in the “Governance Framework” section of this Sustainability Report. For the roles not covered therein, please refer to additional roles below:

The Risk Council, composed of Corporate Center Unit (CCU) Heads, plays a crucial role in establishing a sustainability and climate risk register. They initiate enterprise-wide discussions on risks and provide feedback to risk owners. In collaboration with the CFRO, the Risk Council combines expertise and guidance with strategic direction and risk oversight to ensure effective management of both business and sustainability risks.

The Strategic Business Units (SBUs) are essential in implementing the ERM, sustainability, and climate resilience strategies. SBU leadership continuously refines risk management strategies to address challenges within their specific business areas.

b. Composition

The Board Committee Chairman and Members, who are all Independent Directors and have finance, accounting, and/or business administration backgrounds, are as follows:

GNRSC

- Chairman – Jose T. Pardo* (ID)

- Chairperson – Bernadine T. Siy* (ID)

- Members:

- Renato T. De Guzman (ID)

- Antonio L. Go (ID)

- Artemio V. Panganiban (ID)

*Ms. Bernadine T. Siy replaced Mr. Jose T. Pardo effective June 3, 2024.

E. Board Trainings

Board Training and Orientation

The Company ensures that directors can perform their functions effectively in this rapidly changing environment to cope with heightened regulatory policies, foreign and local demands, and the growing complexity of the business.

Orientation programs are conducted for first-time directors to ensure that new members are appropriately apprised of their duties and responsibilities. This includes an overview of the Company’s operations, Corporate Governance framework, and other relevant topics essential to the performance of their functions. On June 27, 2024, newly-elected Independent Director Ms. Bernadine T. Siy, received an orientation training session regarding the Company, its Corporate Governance structure, and policies.

As a matter of continuous professional education, JGSHI annually organizes in-house corporate governance trainings for its directors and key officers to ensure that they stay informed about industry developments, business trends, and best practices, as provided in the RCGM. An in-house SEC-accredited Corporate Governance session entitled “Building a Resilient Gokongwei Group: Corporate Governance Training on Sustainability, Cybersecurity, and Integrity” was organized and held on September 10, 2024, with the following topics and speakers:

| Topic | Speaker |

|---|---|

| First Session: Unraveling the Link: Corruption and Money Laundering | Atty. Laurinda R. Rogero |

| Second Session: Cybersecurity Governance | Sunil Prabhakaran |

| Third Session: Fireside Chat on IFRS S1/S2 Adoption: Will It Be a Game Changer or More of the Same? | Wilson Tan Atty. Roel Refran Victoria Kalb |

This Corporate Governance training session, which complies with the annual Code of Business Conduct and Ethics and anti-corruption training of the Company, was approved by the SEC to be rebroadcasted on November 14, 2024, for directors and key officers that were not able to attend the September 10, 2024 training.

F. Board Performance Assessment

Board Assessment

An annual self-assessment to evaluate performance is conducted by the Board as a whole, the Board Committees, the individual directors, and the Company’s key officers. This exercise helps them to review their performance, understand their roles and responsibilities, and lead effectively. It also assesses a director’s attendance at board and board committee meetings and participation in boardroom discussions.

The Board Committees’ self-assessment questionnaires contain the following criteria based on leading practices and principles on good governance: A. for the Board: i.) Board Composition, ii.) Board Efficiency and Performance, and iii.) Board Meetings and Participation; B. for the Board Committees: i.) Board Committee Performance, and ii.) Board Committee Structure; and C. for individual directors: i.) Independence, ii.) Participation, iii.) Expertise, iv.) Character, v.) Fiduciary Duty, and iv.) Innovation. On the other hand, the Chairman’s and the President and CEO’s self-assessment questionnaires contain the following criteria: i.) Leadership, ii.) Integrity, iii.) Diligence, iv.) Corporate Governance, v.) Entrepreneurial Mindset, and vi.) Stewardship. Lastly, the key officers, namely the Corporate Secretary, the Chief Compliance Officer, the Chief Finance and Risk Officer, and the Chief Audit Executive were rated based on their key functions.

The annual self-assessment is also supported by an external facilitator every three years and allows for a feedback mechanism for stockholders pursuant to the recommendation in the Code of Corporate Governance for Publicly-Listed Companies (“CG Code”). In 2022, JGSHI engaged Good Governance Advocates and Practitioners of the Philippines (“GGAPP”) as its independent Third-Party Board Performance Evaluator. In 2024, JGSHI customized the GGAPP Form to conduct its Board Self-Assessment. The results were reported to the GNRSC and the Board on November 6 and 13, 2024, respectively. As of February 2025, or three years since the last third-party board assessment, the Company once again engaged GGAPP as its external facilitator.