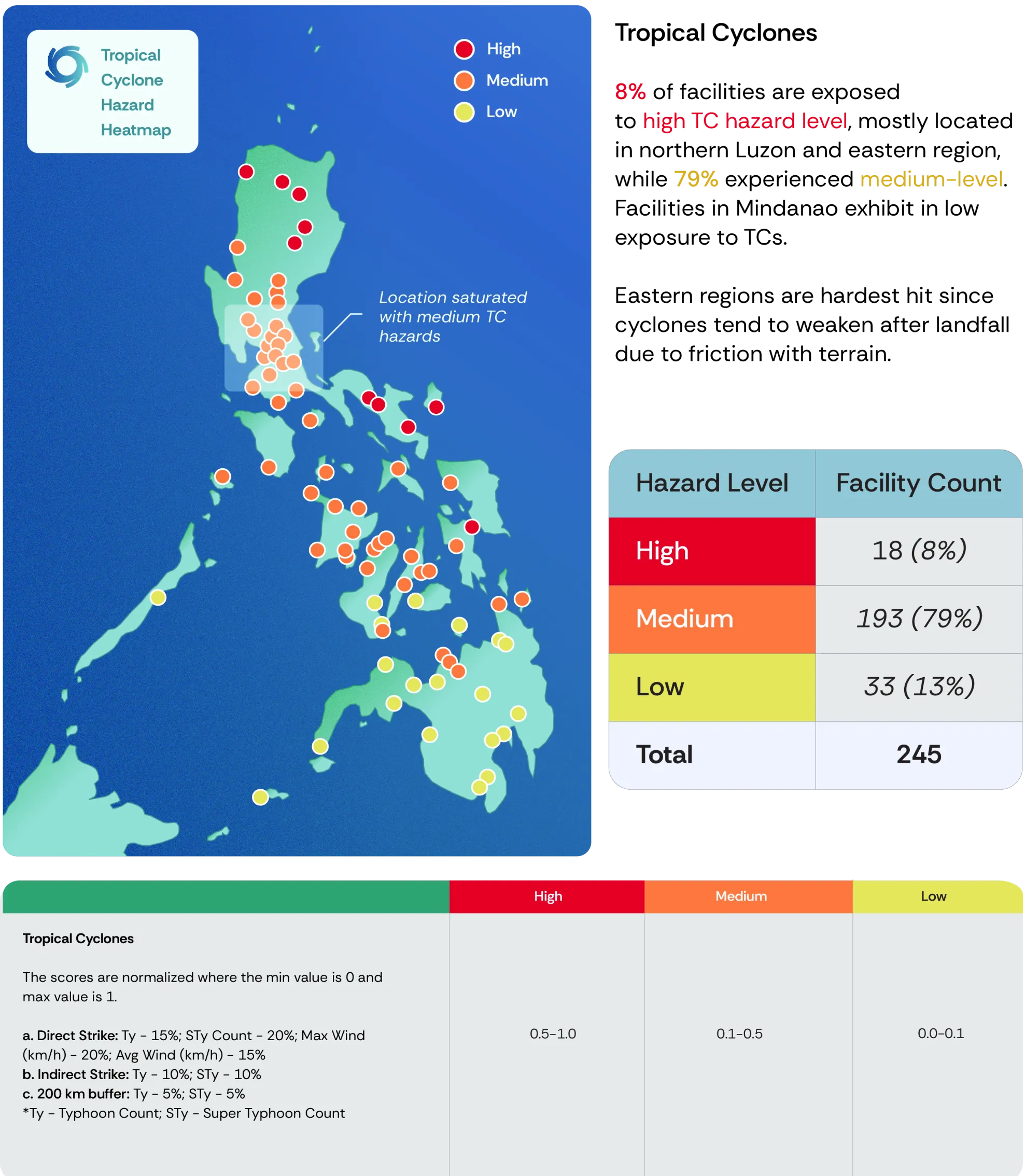

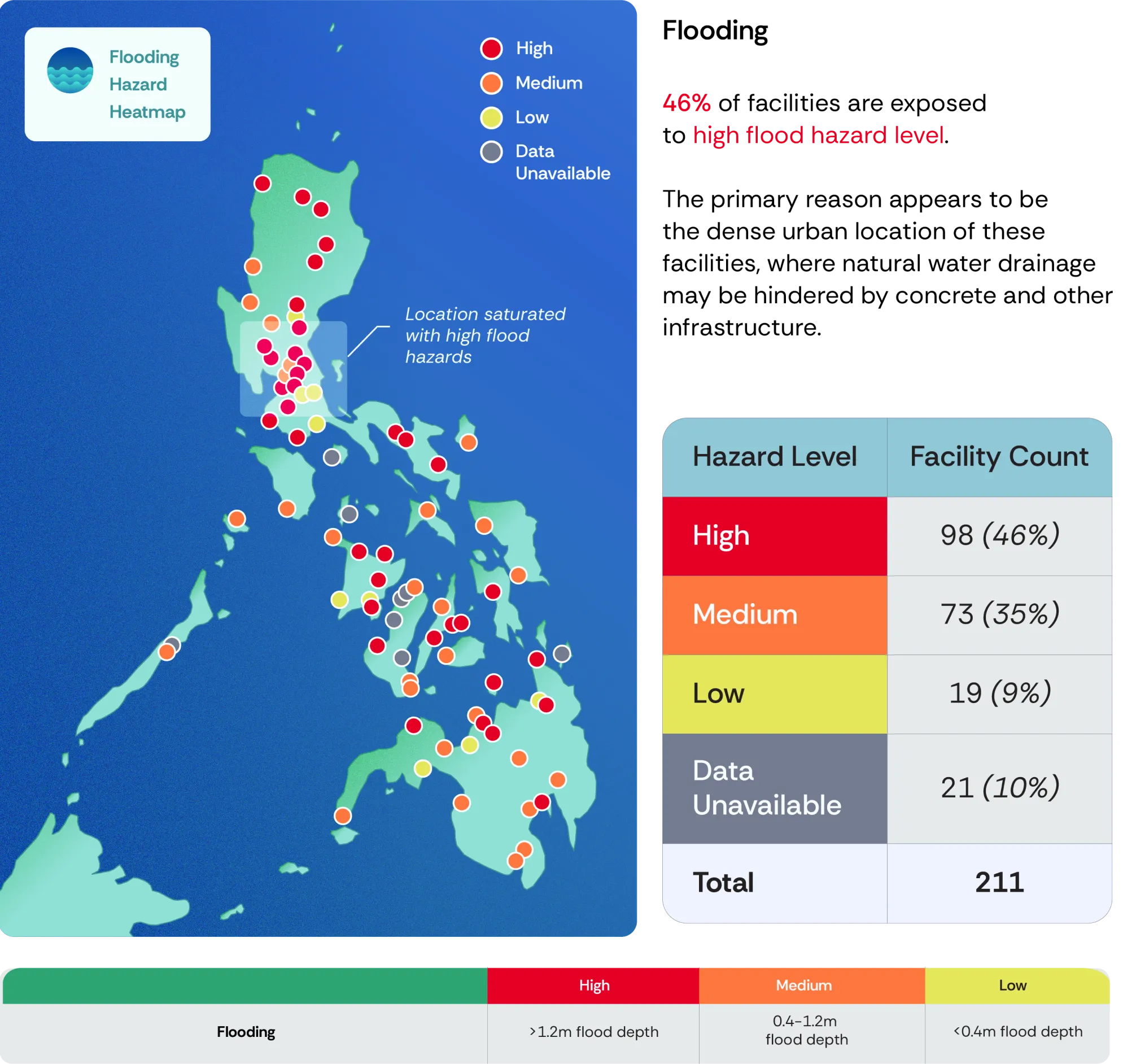

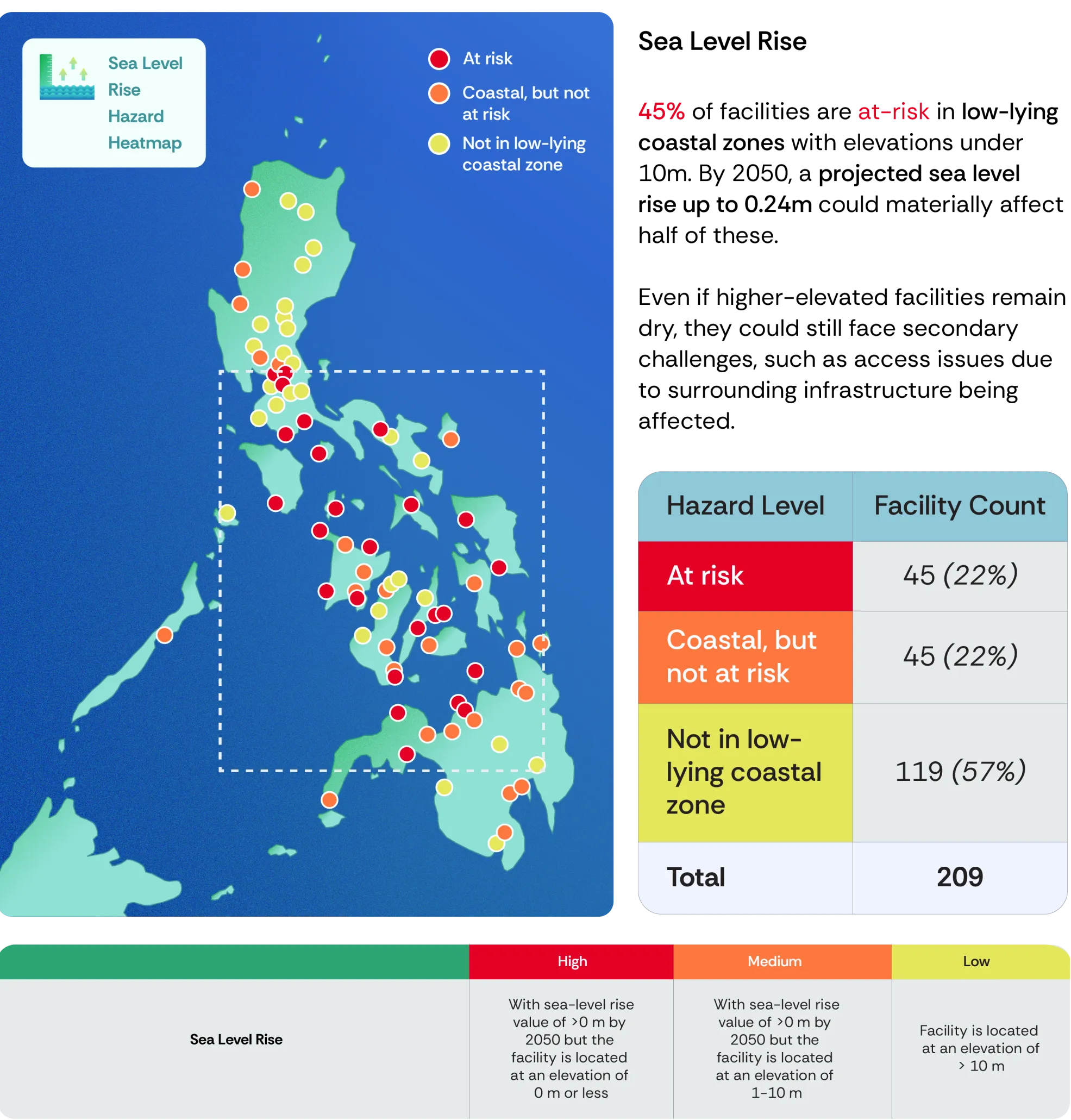

Climate-related physical hazards common in the geographies where our business are located:

tropical cyclones

flooding

extreme heat

sea-level rise

Understanding climate information is crucial for assessing the impact of both physical and transition risks across various future scenarios and making informed decisions for adaptation and mitigation strategies. This is critical as it allows us to assess potential future impacts of both physical hazards and the transition to a low-carbon economy. By considering various climate futures, we can make informed decisions on adaptation strategies to strengthen our operations and mitigation efforts to reduce our environmental footprint, ensuring long-term business resilience.

IPCC's Representative Concentration Pathways (RCP) 8.5 and 4.5 were selected for our analysis. RCP 8.5 represents a high emission scenario, indicating a future where greenhouse gas emissions continue to rise rapidly, resulting in greater impacts from physical hazards such as higher global temperature increase, intense extreme weather events, and faster sea-level rise as a consequence of inaction on climate change. Conversely, RCP 4.5 represents a scenario where emissions peak around mid-century before declining. By considering both pathways, we encompass a broad spectrum of potential future emissions trajectories for climate-related physical risks.

Our definitions of short-term (1-5 years), medium-term (6-15 years), and long-term (16 years and beyond) closely mirror the general timeframes used in our strategic decision-making. The 2030-2060 timeframe, which falls under medium-term to long-term, was chosen to match the projected timelines of climate models and the operational lifespan of assets, ensuring the assessments remain relevant. Additionally, in 2025, we plan to evaluate the impacts of the low-carbon transition and climate-related transition risks and opportunities on our business under the RCP 2.6 scenario.

We applied available physical climate-risk models that the current advancements in climate science from peer-reviewed scientific studies and are subject to refinement as climate science evolves. For temperature projections, we rely on the high-resolution data from the Coordinated Regional Climate Downscaling Experiment for Southeast Asia (CORDEX-SEA), ensuring detailed spatial and temporal analysis. The assessment of future tropical cyclone frequency and intensity utilizes data from the IPCC's Coupled Model Intercomparison Project Phase 6 (CMIP6), which incorporates atmospheric, oceanic, land surface, and sea parameters. Additionally, our flood modeling is conducted using hydrological analysis with the Hydrologic Engineering Center – Hydrologic Modelling System (HEC-HMS) to generate hydrographs and flood maps, incorporating projected rainfall data from PAG-ASA's Climate Information and Risk Analysis Matrix (CLIRAM), ensuring our models are both current and with high spatial and temporal resolution to capture the specific climatic feature of the region.

Determining climate exposure levels for each asset per SBU

292 GG Facilities

41 CEB

115 RLC

49 URC

83 RRHI

4 JGSOC

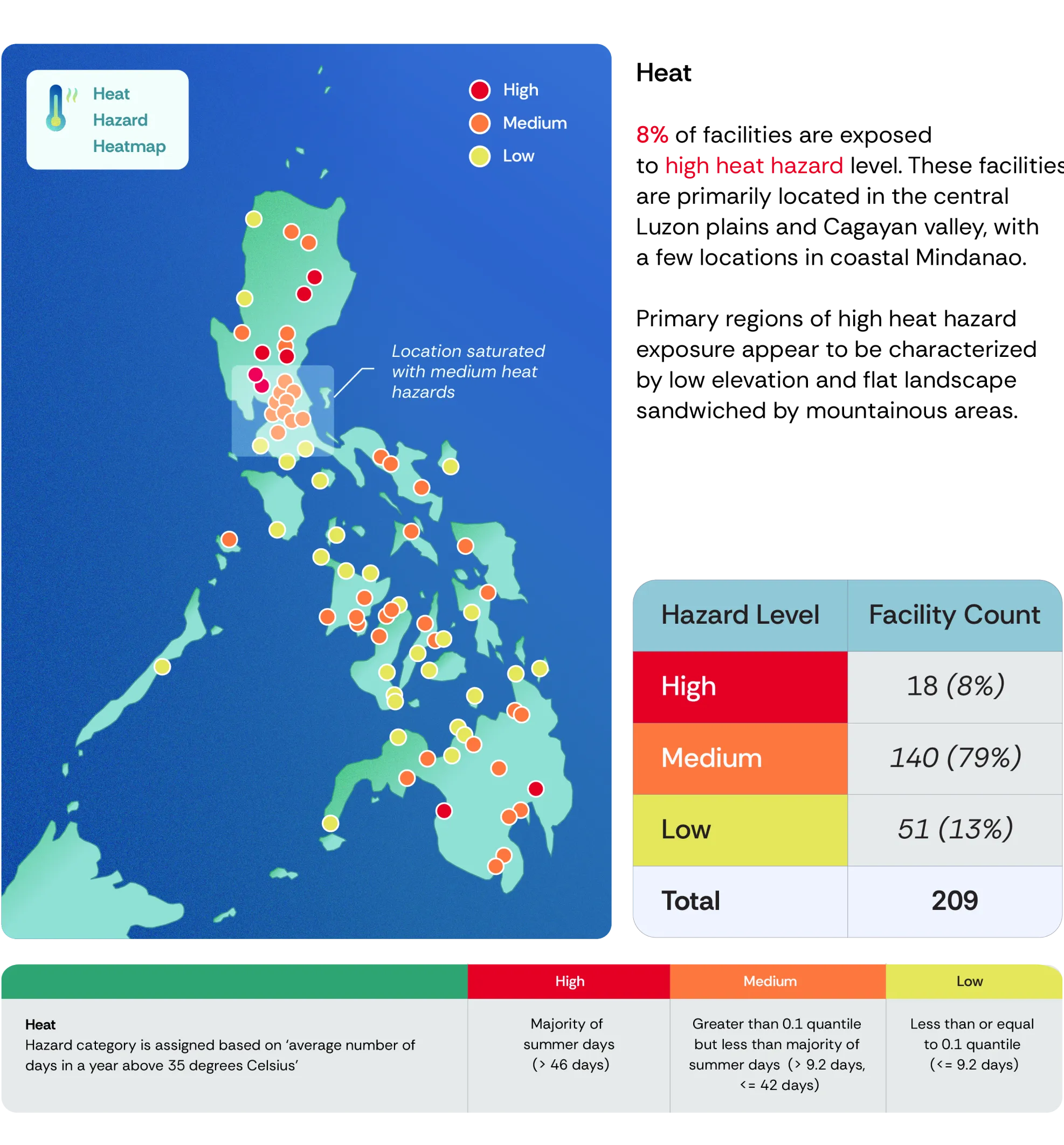

As a first step in ensuring the long-term resilience of our operations, we conducted a comprehensive climate hazard exposure assessment across RRHI and JGS facilities (292 locations) within our Strategic Business Units (SBUs) of CEB, JGSOC, URC, and RLC. This assessment focused on four key climate hazards: flooding, sea level rise, extreme heat, and tropical cyclones. We leveraged geospatial mapping to pinpoint the location of each facility in relation to potential climate hazards which allowed us to assess the corresponding level of climate exposure for each facility. This crucial first step has enabled us to prioritize facilities that require a deeper vulnerability analysis.

Key findings reveal that 46% of facilities are at high flood hazard levels, 45% in low-lying coastal areas may face sea level rise impacts, 8% are exposed to high heat hazards, and 8% to high tropical cyclone risks, highlighting distinct vulnerability profiles across our group’s locations.

Force-rank and select the pilot facility per SBU according to:

Assets with

Medium-High

Climate Level Exposure

Business Credibility

Resource buy-in

alignment

To optimize our climate risk adaptation strategies and resources, we selected pilot facilities for a detailed vulnerability assessment. We collaborated closely with key representative leads within each SBU and applied a forced ranking process. This process prioritized facilities with medium-high climate exposure, critical importance to our business, and resource buy-in from the SBU.

The chosen pilot facilities underwent an in-depth vulnerability assessment, employing a range of advanced methodologies. These included:

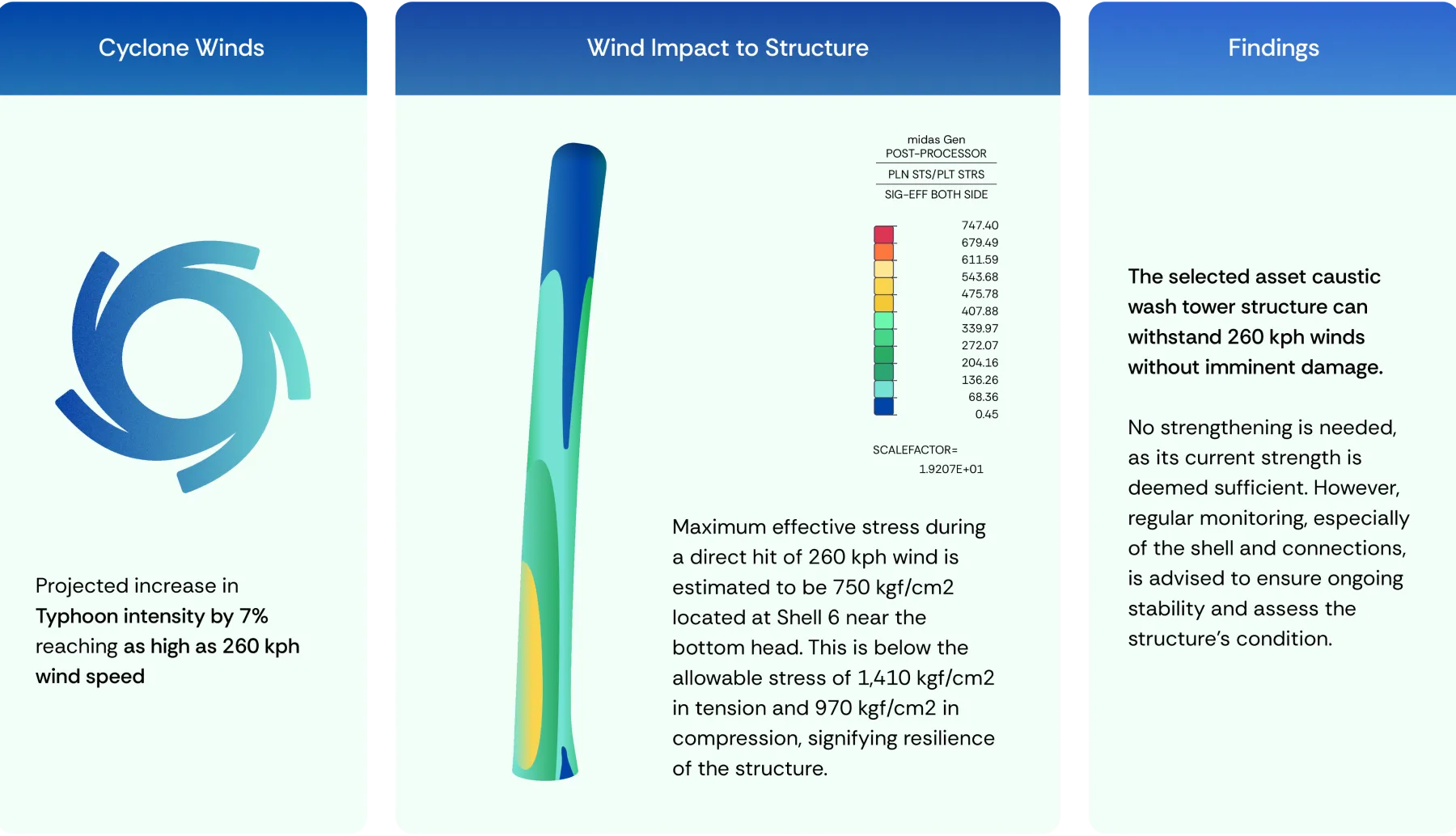

Tropical Cyclone Wind Modeling & Structural Analysis

We modeled the potential intensity of tropical cyclones against each facility's wind design threshold. This detailed analysis identified vulnerable areas and helped us quantify potential damage risks.

Increasing Temperature & Energy Modeling

Rising temperatures were simulated to forecast the impact on energy consumption within each facility, helping us optimize cooling systems and energy management.

Flood Modeling Assessment

We projected precipitation changes and used hydrological and hydraulic modeling to understand their potential impact on facilities, allowing us to plan flood mitigation measures.

This assessment provides actionable insights for enhancing our climate resilience. We now have a robust understanding of the specific vulnerabilities of each pilot facility which allows us to tailor risk mitigation strategies, make targeted investments in structural upgrades, and develop contingency plans. Our commitment to this data-driven approach ensures that we protect our assets and ensure business continuity amidst increasing effects of climate change.

Climate Scenario Analysis has indicated that JGSOC’s Petrochemical Plant, considering its location, is exposed to increasingly intense tropical cyclones. Nonetheless, a wind damage assessment conducted on a representative tower asset demonstrated its capacity to withstand extreme winds of up to 260 kph, aligning with projections for intensifying typhoon intensity impacting the facility's location. This evaluation will also be systematically applied to the other critical asset archetypes to ensure comprehensive risk coverage.

Moreover, the risk of disruptive floods is deemed low, attributed to the plant's elevated topographical setting. Historical records reinforce this outlook, showing no significant typhoon damage or flood-related operational disruptions at the plant, reflecting a proactive emphasis on process safety in its engineering design.

JGSOC will continuously be implementing adaptive measures such as emergency response testing and regular preventive maintenance to fortify its resilience against the evolving challenges of climate change. The proactive integration of climate-related risks and opportunities into the company's overarching strategy will further enhance its capacity to navigate and thrive in a changing climate landscape.

Figure 2. Illustration on the tropical cyclone wind modeling & structural analysis of the caustic tower of JGSOC

Table 1. Material climate-related physical risks to JGSOC

| Climate Hazard | Time Horizon | Description | Potential Financial Impact | Adaptation Measures |

|---|---|---|---|---|

| Tropical cycle (TC) | Medium – Long term (2030 -2060) |

|

|

|

| Flooding | Flooding Long-term (2050) |

|

Strategic Planning

Enterprise Risk Management

Greenfield/Brownfield Investments

Business-Continuity Planning

To inform strategic decision-making and resource allocation, we assessed the potential impacts of climate change on our pilot facilities. The table below provides an overview of the key climate risks identified for each facility, along with their potential financial implications. Based on this assessment, SBUs will take the lead in developing and implementing operational adaptation measures specific to their facilities. JGS will drive the development and implementation of broader strategic adaptation measures that benefit all SBU facilities in the coming years.

Table 2. Key climate-related physical risks

| Physical Risks | Climate Hazard | Time Horizon | Potential Financial Impact | Adaptation Meaures |

|---|---|---|---|---|

| Acute | Tropical Cyclones (TC) | Medium to Long-term |

|

|

| Flooding | Medium to Long-term |

| ||

| Chronic | Extreme temperatures and heat stress | Medium to Long-term |

|

|

Time Horizon: Short-term: (1-5 years) (2025-2029); Medium-term: (6-15 years) (2030-2044); Long-term: (16 years and beyond) (2045 and beyond)

We recognize the importance of transitioning to a lower-carbon economy. This strategic shift has driven several initiatives across our facilities:

Increased Use of Renewable Energy

We are focusing on generating solar and biomass energy on-site, while also sourcing green energy from the grid.

Sustainable Aviation Leadership

Our aviation division, CEB, champions sustainability by adopting fuel-efficient aircraft, integrating sustainable fuels, and modernizing ground support equipment with electric vehicles. These efforts all align with our net-zero goals.

Table 3. Key climate-related opportunities

| Category | Opportunity | Potential Financial Impact | Adaptation Measures | Time Horizon |

|---|---|---|---|---|

| Resource efficiency |

|

|

|

Medium – Long Term |

| Energy Source |

|

|

Short – Medium term |

Time Horizon: Short-term: (1-5 years) (2025-2029); Medium-term: (6-15 years) (2030-2044); Long-term: (16 years and beyond) (2045 and beyond)

Our climate scenario analysis projects an intensification of typhoons, posing a potential material impact on our operations. In this regard, our SBUs have started to adapt resilience measures against extreme climate events. CEB, for example, has established an Operations Planning Group to proactively manage the impact of forecasted weather events in coordination with various departments and airport authorities. Furthermore, we recognize the need to implement engineering interventions, including targeted retrofitting, for older facilities that are vulnerable to the projected typhoon intensity. Our insurance coverage extends to weather-related impacts, and our business continuity plans are continuously being reviewed and will be updated to reflect the anticipated climate risks.

Recognizing the dynamic nature of climate science, we commit to regularly evaluate the robustness of our climate strategy. This ensures our operational practices and investments align with sustainability and climate resilience goals. For 2025, we plan to release our low-carbon transition roadmap that includes the result of transition risks assessment. This proactive approach will help us mitigate risks while also identifying new prospects within the growing climate-resilient marketplace. Through proactive risk management and strategic foresight, we strive to ensure the long-term resilience and sustainability of our operations and the broader value chain.

Over the past years, JGS has made significant strides in climate action. This journey began in 2019 with the launch of a five-year sustainability-integrated strategy across our SBUs and in 2020 with the publishing of our inaugural Sustainability Report.

In 2021, we embedded sustainability and climate risk considerations into our ERM framework. We also established a dedicated Governance and Sustainability Committee at the board level to drive our sustainability and climate agenda. Building on this foundation, 2022 focused on deepening the understanding of the link between business operations and climate impacts. We conducted enrichment sessions on Climate Change for CEOs and Senior Leadership.

Continuing our momentum, 2023 marked the release of group-wide ESG targets, including climate action goals. We also initiated our climate resilience journey. This involved assessing our exposure to physical climate hazards and conducting vulnerability assessments of selected pilot facilities to develop tailored adaptation strategies. These proactive steps position us to adhere to anticipated updates to sustainability reporting guidelines, such as the SEC SR Guidelines. These milestones lay the groundwork for a strategic shift towards a more sustainable and climate-resilient future, setting the tone for years to come.

For future plans, refer to:

2019

SBU adopted five-year sustainability-integrated strategy

2020

JGS published its inaugural Sustainability Report aligned to SEC guidelines and GRI Standards

2021

ERM integration of sustainability risks

Governance and Sustainability Committee at Board Level established

2022

Enrichment sessions on Climate Change for CEOs and Senior Leaderships

2023

JGS ESG targets released

Climate Resilience project (Climate Scenario Analysis) initiated across strategic business units

SBU adopted five-year sustainability-integrated strategy

RLC and CEB released their inaugural Sustainability Report

JGS published its inaugural Sustainability Report aligned to SEC guidelines and GRI Standards

ERM integration of sustainability risks

Governance and Sustainability Committee at Board Level established

Enrichment sessions on Climate Change for CEOs and Senior Leaderships

JGS ESG targets released

Climate Resilience project (Climate Scenario Analysis) initiated across strategic business units

Situated in an archipelagic region prone to tropical cyclones, our businesses face such inherent climate hazards. Intense tropical cyclones, flooding, and rising temperatures could adversely impact our assets, operations, and workforce. As a foundational step in our climate strategy, we have identified and assessed climate-related physical risks and opportunities at a facility level, alongside their operational and business impacts. We have evaluated our climate resilience in coping with the various climate scenarios. This process allowed us to gauge the inherent resilience of our assets and develop tailored risk mitigation strategies to enhance operational efficiency and business continuity. This targeted analysis represents the first phase of a broader strategy that we plan to replicate across our portfolio of critical operational assets and our new investments. We are integrating this climate resilience assessment into our business processes, utilizing them to refine strategic planning, and strengthen our Enterprise Risk Management and Business Continuity Planning. This ensures our approach to managing climate risks is robust and actionable at the operating unit level.

Click a process to read more

We recognize the critical role of climate governance in navigating the evolving challenges of climate change. Our leadership structure enables proactive management of potential risks posed by climate change while simultaneously identifying and seizing new opportunities.

Our governance structure enables informed decision-making at multiple levels:

Board Oversight

The Board provides top-level oversight, ensuring the effectiveness of our overall climate strategy.

Management Execution

The Management Level focuses on integrating the climate agenda throughout the portfolio and reports progress to the Board.

Operational Integration

Operating units implement the climate-related strategy, ensuring its integration within day-to-day activities and alignment with corporate goals.

Click the diagram to view

The Board of Directors oversees the management of climate-related risks and opportunities, ensuring that climate considerations are seamlessly integrated into our strategies, procedures, and systems. The Board, through the Audit, Risk, and Related Party Transaction Oversight Committee (AURROC), evaluates management's actions on risk matters and reviews and approves Objectives, Goals, Strategies, and Measures (OGSM) to accelerate our sustainability and climate action initiatives across the group’s businesses and stakeholder engagements.

The AURROC initiates regular reporting to the Board on climate-related risks and material exposures. It proposes adjustments to risk appetite and tolerance in response to climate and business developments, regulatory changes, and significant external events. The AURROC oversees the ERM framework, ensuring policies adequately address climate-related risks for both operational and financial resilience. It also guides the development, implementation, and evaluation of our climate-related risk management plans.

Supporting the Board alongside AURROC is the Governance, Nomination, Remuneration and Sustainability Committee (GNRSC), which oversees the development and implementation of corporate governance principles and policies, with a focus on Economic, Environment, Social, and Governance (EESG) aspects of sustainability. The GNRSC reported climate-related matters to the Board in two meetings in 2023. Furthermore, the GNRSC reviews and recommends approval of our Climate Disclosure Report for submission to regulatory bodies and public release. It also evaluates management's effectiveness in maximizing climate-related opportunities.

Our Executive Leadership Council, composed of Corporate Center Unit Heads and Strategic Business Unit CEOs, addresses climate-related risks and opportunities. Led by the President and CEO, they develop and execute strategies to manage climate-related risks and maximize opportunities for the organization.

The President and Chief Executive Officer (CEO) sets the overall strategic direction for the conglomerate, including our approach to sustainability and climate action, playing a central role in driving climate initiatives, managing climate risks, and ensuring transparent reporting on our climate performance.

The Chief Finance and Risk Officer (CFRO) oversees our ERM processes, establishing a robust framework for managing climate-related risks, alongside other key business risks. The CFRO communicates significant climate risk exposures and mitigation plans to AURROC.

The Chief Corporate Affairs and Sustainability Officer (CCASO) develops strategies that align with the company's sustainability goals and commitments, including those related to climate change mitigation and adaptation. Engage with policymakers and regulatory bodies to advocate for policies that support climate action, such as carbon pricing mechanisms, renewable energy incentives, or emissions regulations.

The Chief Strategy Office (CSO) ensures that climate considerations are integrated into the company's broader business strategy and that ecosystem synergies are maximized, where possible, in approaching climate change as a group. Apart from this, the CSO also participates in investor conferences, roadshows, and other engagement platforms to communicate the company's climate strategy, goals, and progress directly to investors. This provides an opportunity to address investor concerns, answer questions, and demonstrate the company's commitment to sustainability.

The CCASO and the CSO jointly oversee the development and integration of our climate transition plan into our businesses, including setting climate targets and assessing climate risks and opportunities.

The Sustainability Head designs and leads the development of our Climate Resilience and Transition plans within which relevant risks and opportunities are identified and then help SBUs achieve climate related targets. The Sustainability head provides strategic directions, builds stakeholder relationships, and monitors Sustainability performance.

The Risk Council, composed of JGSHI Corporate Center Unit (CCU) Heads, plays a crucial role in establishing a climate risk register. They initiate enterprise-wide discussions on climate risks and provide feedback to risk owners. In a collaboration between the CFRO and Risk Council, expertise and guidance are combined with strategic direction and risk oversight to ensure effective management of both business and climate risks.

Our Strategic Business Units (SBUs) play a vital role in operationalizing our climate resilience strategies. SBU leadership implements and continuously refines risk management strategies to address climate-related challenges within their specific business areas.

The SBU Chief Risk Officers (CROs) spearhead the establishment of robust Enterprise Risk Management (ERM) frameworks within each SBU. These frameworks are tailored to effectively identify, monitor, assess, and manage key climate-related risks faced by the SBU.

SBU CEOs ensure alignment between climate and sustainability strategies and the company's overall goals. They monitor the effectiveness of these initiatives and report progress directly to the President and CEO.

The SBU Sustainability Leads Council further supports this effort by regularly reviewing each SBU's approach to climate risk management. This council proactively identifies climate-related opportunities, promotes knowledge sharing of best practices, facilitates capability-building opportunities, and provides a platform for collaboration to maximize ecosystem strengths.

SBU ERM Teams play a crucial role in implementing and refining climate-related risk management strategies within their respective business units. They implement controls for climate risks, review the risk register, and recommend risk appetite adjustments for consideration by the SBU's Risk Council and CRO.

The SBU Sustainability Leads Council further supports this effort by regularly reviewing each SBU's approach to climate risk management. This council proactively identifies climate-related opportunities, promotes knowledge sharing of best practices, and facilitates training and periodic reviews for SBU employees.

As discussed in the ERM and Internal Controls, our ERM strategy takes a holistic approach to addressing climate-related risks and maximizing climate-related opportunities within our framework. Our comprehensive process embeds climate-related risks and opportunities into the overall ERM framework through the following steps: 1) Risk Identification, 2) Risk Assessment, 3) Risk Prioritization, and 4) Risk Response, Monitoring, and Evaluation.

Climate-related risks and opportunities are integrated into our ERM system and managed at both the Management and Operating Unit Levels. Identified as a Climate Risk category in the Group's risk register allows us increased focus on climate risk identification and mitigation. Climate-related risks undergo semi-annual reviews by the Risk Council and the Group Risk Management Committee. Furthermore, our commitment to decarbonization and the integration of an energy management system into our balanced scorecard underscore the inclusion of climate-related factors in our overall risk management strategy. Climate risk assessment and climate scenario analysis are being integrated into our overall ERM system by identifying physical risks, evaluating impact, prioritizing urgency, and executing resilience strategies, which is articulated by the figure below.

Overall Enterprise Risk Management

Click on each segment to learn more

Risk Identification

Incorporation of climate hazards (tropical cyclone, flooding, increased temperature, sea-level rise) into risk factor analysis.

Risk Assessment

Mapping of the company’s assets and facilities exposed to each climate hazard.

Selection of the critical assets for in-depth analysis based on potential impact, strategic importance, and resource availability.

Conducting detailed climate scenario analysis using different climate scenarios (RCP 4.5, RCP 8.5) for selected assets.

Utilizing tools like structural and vulnerability assessments. flood modeling, and temperature / energy usage modeling to quantify potential impacts.

Risk Response, Monitoring and Evaluation

Development of climate-specific mitigation and adaptation strategies based on the identified risks and impacts.

Regularly monitor climate data and update risk assessments as needed.

Evaluate the effectiveness of implemented mitigation and adaptation strategies and make adjustments as necessary.

Risk Prioritization

Consider both the likelihood and potential impact of climate-related risks alongside other organizational risks to assess priority.

Prioritize climate risks based on urgency of response and potential disruption to critical operations.

Risk Identification

Incorporation of climate hazards (tropical cyclone, flooding, increased temperature, sea-level rise) into risk factor analysis.

Risk Assessment

Mapping of the company’s assets and facilities exposed to each climate hazard.

Selection of the critical assets for in-depth analysis based on potential impact, strategic importance, and resource availability.

Conducting detailed climate scenario analysis using different climate scenarios (RCP 4.5, RCP 8.5) for selected assets.

Utilizing tools like structural and vulnerability assessments. flood modeling, and temperature / energy usage modeling to quantify potential impacts.

Risk Response, Monitoring and Evaluation

Development of climate-specific mitigation and adaptation strategies based on the identified risks and impacts.

Regularly monitor climate data and update risk assessments as needed.

Evaluate the effectiveness of implemented mitigation and adaptation strategies and make adjustments as necessary.

Risk Prioritization

Consider both the likelihood and potential impact of climate-related risks alongside other organizational risks to assess priority.

Prioritize climate risks based on urgency of response and potential disruption to critical operations.

Climate hazards are factored into the risk identification analysis, where our risk champions and risk owners utilize various tools to highlight elements that could hinder their business unit's objectives. In line with our overall ERM framework, this process includes Risk Factor Analysis, Megatrend Analysis, and Systems Dynamics Analysis for systemic ESG-related risks.

We adopt the same risk assessment scale, categorizing impacts as insignificant to extreme and likelihoods from rare to almost certain, based on their inherent nature. Similar prioritization criteria based on our organization's risk profile, vulnerability, and their urgency are applied. Thus, the company's most critical assets are prioritized by pinpointing their exposure to climate hazards. Using detailed climate models and scenarios (RCP 4.5 and 8.5), it then quantifies the potential impacts on these assets through specialized tools. In short, it identifies weak spots and measures potential damage from climate change.

Climate-related physical and transition risks are categorized as Climate Risks and are ranked number 5 among the Top 10 risks. Climate-related risks pose a potential adverse impact to operations, particularly in the face of extreme weather events. Regulatory changes linked to climate change, such as carbon pricing, emissions caps, and extended producer responsibility, may impact operations by escalating compliance costs. The insights from the CSA are being incorporated into the group's ERM system, enhancing our management of climate-related risks and opportunities. This integration deepens our understanding of the potential likelihood and severity of climate risks, enabling more informed decision-making in prioritizing and response planning.

We ensure the implementation of suitable risk responses for each climate-related risk, both at the risk owner level within our operating companies and at the enterprise-wide parent level. Risk owners are responsible for managing climate-related risks and collaborate with risk champions to develop effective management strategies to reduce environmental impact and adapt to climate threats. They follow the same reporting process as our ERM dictates, updating the AURROC at least twice a year. Risk champions also oversee the continuous monitoring of climate data and yearly evaluation of risk response effectiveness.

Given the dynamic nature of risks, the entire risk management process is iterated as separate and independent processes at the functional units of our operating companies and as a group-wide process.

Group-wide action plans for climate-related risks are being developed in collaboration with SBUs and CCUs. Continuous monitoring of legislative proposals and regulatory trends is in place, ensuring timely identification of potential effects on operations. The company is proactively future-proofing its holdings by setting climate-related targets that meet or exceed potential regulatory requirements. We also continuously integrate the identified climate-related risks, specifically extreme weather events, into our business continuity plans and crisis management plans to ensure the group’s resiliency.

We are proactively anticipating future climate conditions, and identifying opportunities arising from changing consumer behaviors, new market developments, and innovations aligned with ongoing climate trends. This process includes a thorough evaluation of potential climate-related opportunities, pinpointing those that complement the company's core strengths, contextual relevance, and prevailing market trends.

Each identified opportunity will be assessed for its financial, operational, and reputational implications to gauge its feasibility. We will rank these opportunities according to how well they align with our corporate and sustainability objectives, evaluating their feasibility, potential for expansion, and compatibility with current business initiatives.

To stay ahead, we will regularly revise and update our approach at least semi-annually in response to changing climate conditions and market shifts. This continuous monitoring and refinement highlight our commitment to the actively evolving landscape of climate-related opportunities.

We continuously enhance our risk management system, demonstrating a commitment to addressing evolving challenges. Documentation of controls in place against identified risks and ranking of the top risks are priorities. Notably, in this latest reporting period, we have integrated climate scenario analysis into our risk identification and assessment processes. This strategic initiative has empowered us to proactively anticipate and address potential climate-related risks.

To provide our shareholders and stakeholders with clear insights into our approach to managing climate-related risks and opportunities, we have set specific environmental and climate-related targets and are tracking our progress.

To demonstrate our approach in managing the physical climate-related risks, we reflected metrics for exposure and vulnerability assessment coverage associated with flooding, tropical cyclones, extreme temperature and heat stress, and sea level rise.

| Metrics | Current Performance | Ambition |

|---|---|---|

| Exposure Assessment Coverage | 292 of the mapped-out facilities of the SBUs: URC, RLC, CEB, RRHI, and JGSOC. | Integrate climate hazard exposure assessment for new facilities/greenfield investments and newly acquired assets/brownfield investments |

| Vulnerability Assessment Coverage | One (1) representative asset, facility, or operation per SBU: URC's SURE SONEDCO, JGSOC's Petrochemical Plant, RLC's Giga Tower, RRHI's Sucat Distribution Center, and Cebu Pacific's Operations at NAIA Complex. | SBUs to replicate vulnerability assessment in their identified critical sites, as well as new sites |

| Disclosure | Unit | 2023 Quantity | Boundaries |

|---|---|---|---|

| Total GHG emissions | tCO2e | 2,585,360 | URC, CEB, RLC, JGSOC, RBank, CCU |

| Gross Energy direct (Scope 1) GHG emissions | tCO2e | 2,171,880 | |

| Gross Energy Indirect (Scope 2) GHG emissions | tCO2e | 302,488 | |

| Gross Other Indirect (Scope 3) GHG emissions | tCO2e | 110,991 | RLC |

| GHG emissions intensity | tCO2e/MPhP | 7.20 | URC, CEB, RLC, JGSOC, RBank, CCU |

We calculated our total greenhouse gas emissions using the equity approach, as recommended by the GHG Protocol Corporate Accounting and Reporting Standard. This includes measuring and reporting our scope 1, 2, and some scope 3 carbon emissions.

For scope 2 emissions, we utilize a location-based approach. Scope 3 emissions are disclosed for electricity usage by RLC tenants only, with plans to expand this to include other business activities. Furthermore, we are considering internal carbon pricing to anticipate the potential financial impacts of future regulations, taxes, or carbon pricing mechanisms that may be introduced by governments or influenced by market forces and utilizing carbon credits.

To ensure our businesses transition to low-carbon practices, we are developing our Low Carbon Transition Roadmap, which will be released by 2025. Additionally, this roadmap will be aligned with our aspiration to attain a Net Zero target by 2050.

Approach to accelerate our climate action and resilience journey

Click the diagram to view

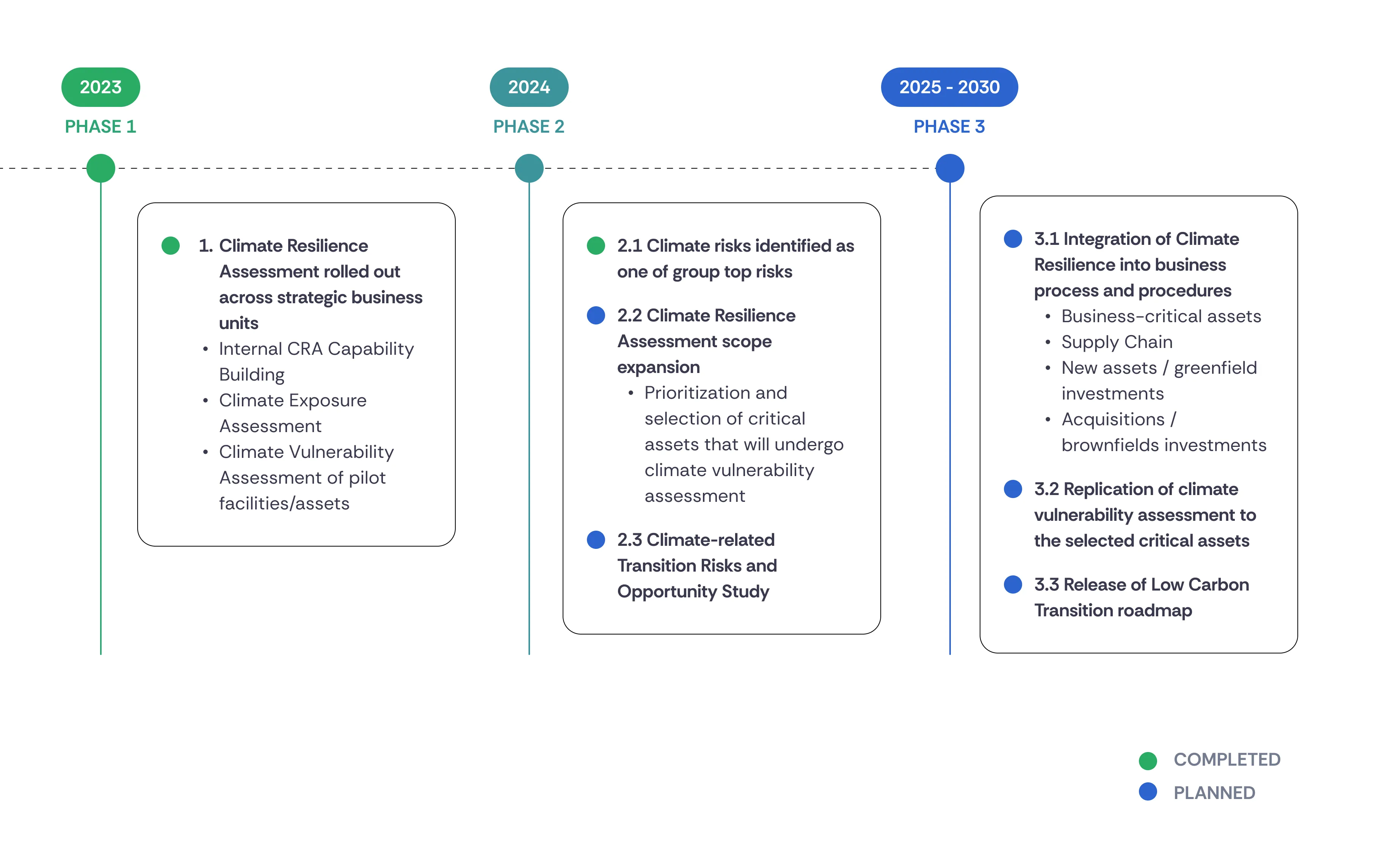

We are actively building resilience against the impacts of climate change. Our three-phased approach, outlined in the timeline, focuses on assessing climate risks, integrating climate resilience into business practices, and developing a low-carbon transition roadmap.

The year 2023 is about building a strong foundation. We laid the groundwork for climate resilience by building internal capability to enhance knowledge on climate-related risk and resilience, assessing our exposure to physical climate hazards, and conducting vulnerability assessments of selected pilot facilities to develop tailored adaptation strategies.

In 2024, we have recognized climate risk as one of the group's top risks, reflecting how we prioritize it relative to other types of risk. We will plan to expand the climate resilience assessment scope to cover more facilities that will undergo in-depth vulnerability assessment. We also plan to further understand and evaluate the impacts of the low-carbon transition by conducting a group-wide climate-related transition risks and opportunities assessment study.

From 2025 onward, our focus shifts to integrating resilience and embedding climate considerations into operational decision-making and replicating vulnerability assessments for wider coverage, and releasing our comprehensive low-carbon transition roadmap outlining our path to Net Zero.

This proactive, phased plan demonstrates our dedication to building a climate-resilient business, safeguarding our operations, and ensuring long-term sustainability.